The world of financial markets can be complex to do business at optimal prices with different types of orders that aim to do business. Two main categories are market orders and boundary orders. Understanding the differences between these two orders can help you to control the markets more effectively.

market orders

Definition:

A market order is an order to buy or sell security at its current market price, regardless of whether there is a better price in the market elsewhere.

ProS:

–

Speed and efficiency: market orders are carried out immediately when they are placed, which can be faster than waiting for a better price.

–

Best execution prices: Since these orders are executed at the current market price, you will receive the best possible execution price.

–

No time drop: In contrast to border orders that can fall or lose the value, if you do not match an offer on the other side of the trade, market orders are guaranteed to be filled out immediately.

border orders

Definition: A border order is an order for buying or selling a security at a certain price (exercise price), which you determine and that can be higher than the current market price. The aim is to use potential price movements in their favor and limit the losses when the prices fall below their desired level.

ProS:

.

–

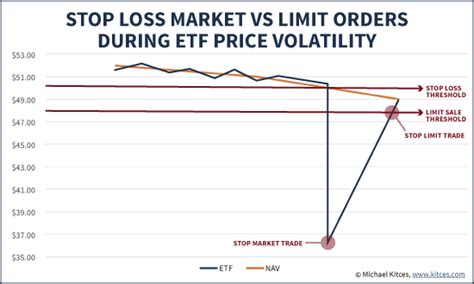

Protection against price volatility: If you set a limit, you can protect yourself from sudden price movements that may make it difficult or expensive to buy or sell security at the best possible price.

key differences and considerations

- Executional speed:

The market orders are generally faster than limiting orders, since they are carried out immediately in the task.

- Best execution prices: Both types of orders strive for the best possible execution price, but market orders guarantee that you will receive this price, regardless of where other dealers are willing to buy or sell at the same time.

- Time decrease and price risk management: Limitation orders can be more effective when managing the risk if you try to avoid losses from price movements that may not be cheap. However, they require a careful facility to ensure that they are carried out when the market is ripe for their desired trade.

Select

between market orders and boundary orders

–

If speed and efficiency are of crucial importance: If you have to carry out a trade quickly or if speed is not a problem due to your account or trading strategy, a market order may be a better choice.

–

For price management and flexibility: If you use potential price movements in your favor and at the same time restrict the losses, the limitation orders are more suitable.

In summary, both types of orders have their place in various market scenarios. Understanding these distinctions can help you to make well -founded trading decisions based on your risk tolerance, trade goals and the current market conditions.