Cryptography Currency: Market Signs and their Effect on Ethereum Price

One of the mandatory windows on the platforms is Ethereum (ETH) in the rapidly ovolvinous world of cryptocurrencies. Ethereum as a decentralized application (DAPP) platform allows Veser to build, deplet and manage smart contracts and decent applications. Howver, such as the market, ETH price is not immune to external factors that can affect its value.

In this article, we will investigate the relationship between cryptocurrency marking signals and their impact on Ethereum prices. We will test the type of labeling tires, including news, events, social media mood, technical indicators and more. The organic goal is to give an insight into how they note the signs of ETH prices and help investors make deliberate decisions.

What are market signals?

Market signals refer to all information that provides an aspect or reference to topics to you cryptoource. TESE can come from a variety of sources including:

1

News : News, anonouncments and updates related to Ethereum projects, partner ships or development.

- Events : Main events such as ICO (initial coin offers), merger and takeover, as well as regulatory changes affecting the cryptocurrency market.

3

Social media mood : Ositon and emotions expressed by social media users, influencers and online communications by regulating ETH Prcees.

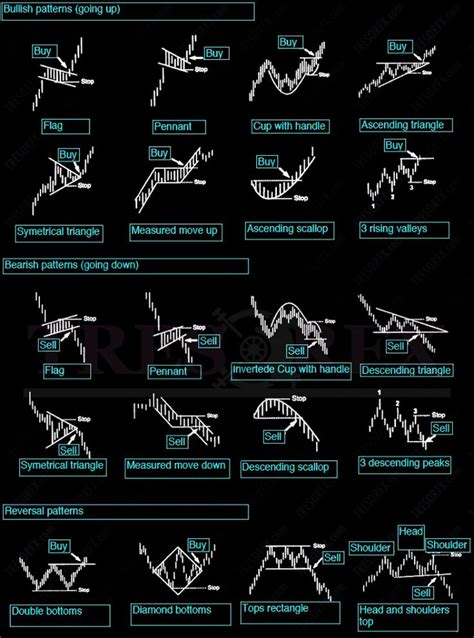

- Technical Indicators : Indicators such as relative strength index (RSI), variable average (MA) and Bollinger bands, which will be analyzed by sophisticated and predicative fur trends.

- Market trends : long -term trends and models of cryptocurrency that affect short price movements.

Impact outside market signals is Ethereum prices

Ethereum prices have historically occurred with a variety of market signals that can be widely divided into three lines:

- Positive signals

*

* News: Positive information on Ethereum projects, partnerships, or development that offends an increase in ETH printouts.

* Events: Successful ICO, Substances and Purchase or Regulatory Changes that Benefit Ethreum Candrade.

- Negative sign *

* News: Negative news on Ethereum projects, partnerships or development can be decorated with prce.

* Events: Authenticity of major events, failure in the project, the usual publicity surrounded by an Ethereum project can have a negative impact on prices.

- Neutral signals

* Social Media Mood: Sentiment Amon Social Media Users, Affecting and Online Communication Changes in ETH can affect marketing.

* Technical indicators: Price movements and models analyzed by technical indicators can provide insight into future transaction trends.

Etherum Delivery Side Factors

While markets signals are an essential part of the cryptocurrency currency landscape, Ethereum’s soup game plays an important role in its print determination. Some main considerations are:

1

Tokenomics : Total ETH delivery and marker deficiency can affect prce.

- If Max : Incresing will be an Ethereum network, reducing demand such as ETH.

3

Volume volume : reducing the volume of the transaction to read them.

Thought closure *

Crypto currency marking signals are the most important aspect to understand the price movement of Ethereum. Analyzing various marking signal marks and their effects, investors can be a compressive view of cryptocurrency markers. Understanding these factors is very important to make conscious investor decisions and navigates in the world of cryptocurrencies.